Al Waqf: A Divine Marketing Strategy for Perpetual Generosity

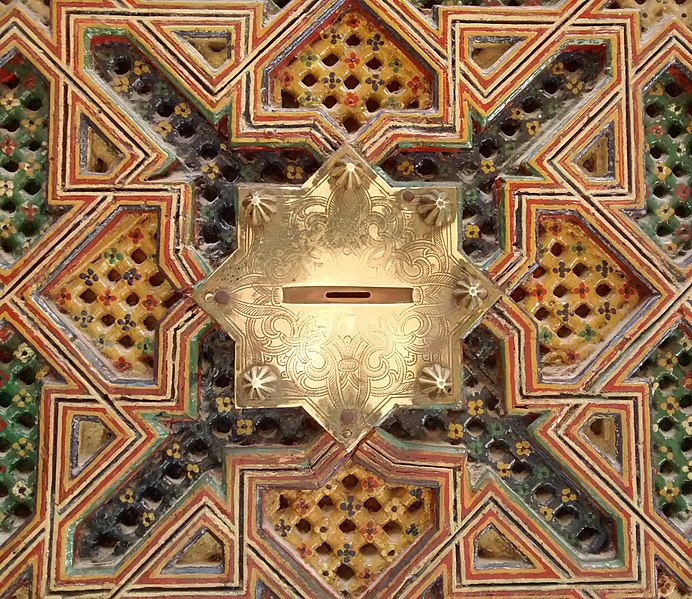

Credit: Mx. Granger via Wikipedia

24 April 2016

| Giver: | Individual |

|---|---|

| Receiver: | - |

| Gift: | Items |

| Approach: | Other |

| Issues: | 11. Sustainable Cities and Communities, 16. Peace, Justice and Strong Institutions |

| Included in: | African Philanthropy Narratives |

Waqaf is a verb in Arabic that literally means to “stop”, “halt” or “stand still”. Al Waqf is a noun that describes the condition of holding or preventing something from moving. In this sense, Al Waqf as a concept refers to any property that is held untouched, for instance, a good old olive tree that you have no permission to move, transfer, sell or uproot; yet you can harvest its olives to feed others. In doing so, you need to make sure that the olive tree will live, grow and reproduce to be able to give more olives in perpetuity. Al Waqf is like this investment in the core capital, so that it generates profits for maximum benefits for humanity.

Waqf as an Islamic giving model

Giving is a pillar among the five pillars of Islam; it defines Muslim identity and practice. Al Waqf (hereafter called Waqf) is one of the giving models that have origins in Islamic teachings, especially through the sayings and narratives of the Prophet Mohamed and his companions. It is a voluntary form of giving that incorporates the concept of perpetuity into its very essence. Waqf translates in religious texts as a “sadaqa jariyah” which means the perpetual rightful-giving. Perpetuity and rightfulness are the core principles and values of Waqf. Thus Waqf describes any stream of giving that continues indefinitely to fund or support a good cause.

This concept as a faith-driven sustainable funding model also existed in ancient civilizations. The Pharaohs of ancient Egypt, for instance, had their waqf structures in the form of properties, held untouched, to generate income that supports and maintains temples. Throughout history in Egypt, all the three monotheistic religions have had their own waqf structures, and people of faith have created waqfs or awqaf (plural of waqf) seeking perpetuity.

Thus, Waqf reflects a belief that conveys the commitment and dedication associated with creating and maintaining a sustainable financial model for social benefit. This goes back to one saying by Prophet Mohamed that encourages people to be generous yet also to make sure that their giving is everlasting and enduring indefinitely: “When a human being dies, all one’s deeds cease, except for three:

- Sadaqah Jariyah (a good deed that has long-term benefit in this life and the next– this includes but is not limited to Al Waqf );

- Knowledge (or Science) from which others benefit; and

- A righteous child who prays for one”.

Al-Waqf and Sadaqa Jariyah are the two sides of one coin that encompass all the three elements mentioned in this saying, whether financial investment that enables a social contribution in perpetuity, the knowledge that spreads from a person to another enabling continuous and everlasting education and development; or the idea of sons, daughters, students etc. who are raised to be good citizens, and in doing so raising the status of parents, teachers and mentors who are influential role models shaping a kind and prosperous future. This, too, is an act of sustainable giving as it helps transfer good acts from one generation to the other, making parents, mentors, teachers and scientists agents of change recognized for their perpetuated generosity. All these three pillars are equally well respected and highly regarded across north African countries. They are part and parcel of strategic philanthropy and they perpetuate generosity. They are seen as equally important not only for the good deeds that continue in this world, but as continuing rewards even when our lives on earth cease. These sadaqa jariyah pillars differ fundamentally from individual, ad-hoc, service-based, short-term charity.

Types of Waqfs/Awqaf

While this article focuses on waqf in relation to societal well-being, it is important to note that in Islam, there are three types of Waqfs.

- **Waqf al Khayri (Charitable Waqf): **This pertains to philanthropic investments that support charitable or developmental causes, contributing to societal well-being.

- **Waqf al Ahli (Family Waqf): **This involves an investment created by the Waqf founder, stipulating that the Waqf's income is designated to support members of their family, often motivated by desire to safeguard against property division due to inheritance laws.

- **The Joint Waqf: **This encompasses an investment strategy that serves dual purposes by supporting both charitable causes and family members, reflecting a comprehensive approach to philanthropy and family support (El Daly, 2022).

In modern literature, “Waqf” has been often used interchangeably with the concept of “endowment”. This literal translation, however, diminishes the practice and does not fully capture the depth and range of the concept. Waqf is much more than a financial tool and much more than cash funds. Four factors make waqf distinct:

- Waqf can manifest in different kinds of assets, ranging from land, agricultural assets and buildings to cash and shares, as well as different kinds of income-generation projects.

- The whole idea of Waqf revolves around the idea of altruism (takafol in Arabic) which indicates that at the core of waqf lies the idea of social justice and inclusivity of all people.

- The idea of perpetual generosity and perpetual reward. In Islam, there is strong belief in the concept of the afterlife and the waqf gift allows the waqf creator or “waqif” to transcend beyond her/his physical life through a perpetual good deed that will continue generating hassanat (rewards) even after one’s death.

- Waqf is linked to some form of social impact. This is the main condition that validates its existence.

Waqf Management

A waqf can be created either individually or collectively (as a group donation). The waqif decides to allocate his/her wealth for a specific cause that matters to them. In Egypt, as well as in all North African countries, the process of waqf creation has been as follows:

- An endower decides to allocate his/her wealth for a specific cause of interest to him/her.

- The endower writes a “deed” of the waqf specifying:

- The amount of the corpus (the original capital/property),

- The purpose for which it is endowed and

- The management conditions.

- How the annual revenue generated by the waqf should be spent.

- The management is entrusted to the trustees (the founder might serve as a trustee during his/her lifetime)

- This deed is submitted to the authorities.

This process ensures transparency and legal validation for the establishment of the waqf, providing a framework for the effective management and utilization of its resources according to the wishes and intentions of the waqif, called “_Shart al Waqif”, _and is of utmost importance to be respected.

The responsibility for managing the waqf is typically entrusted to trustees, Nuzzar (plural) or Nazir (singular). In the Ottoman Empire, the waqfs were managed by either the founders, or by the trustees that were appointed by them. 76% of the waqfs there were managed by the trustees (Cizakca, 2013). Historically, in most of the North African Islamic countries, the waqfs were managed by the trustees. This, however, changed with the development of the modern states in the early 19th century; all private waqfs were confiscated and put under the control of ministries, often called Ministry of Waqfs/Awqaf or Hubus. In the Gulf and countries like Malaysia, the sole trustee of the waqfs is the state (Khalil (2015).

This resembles the case of most of the Islamic countries today, though the independence and management of waqf is different in non-Muslim majority countries. In Egypt, there is a movement to revive the establishment of independent waqf structures that are managed by a board of Nuzzar. Recently, Waqfeyat Misr Foundation (Waqf Foundation of Egypt) was established as a national foundation working across Egypt to revive and innovate waqf management in Egypt (<https://www.facebook.com/waqfeyatmisr/>). This effort is in line with Egypt’s newest constitution of 2014, which added Article 90, that calls upon the government to revive and protect private waqf structures.

Characteristics of Waqf

- Perpetuity: The waqf by default is an economic model that seeks perpetuity. It is created to last beyond the lives of its endowers.

- Inalienability: The money tied as a waqf needs to remain a waqf and is not subject to any inheritance law.

- **Irrevocability: **Which gives this giving a form of permanency as it cannot be revoked.

Although these are common characteristics of waqf, the application has never been entirely straightforward. Certain legal and regulatory conditions in some contexts have permitted waqf creators to establish time-framed waqf that could potentially be revoked. In many instances, even when waqf funds were initially intended for perpetuity, achieving such longevity was not always realized.

Waqf and education.

Waqfs have been used to benefit society through multiple avenues. One of these is education.

There is a historical connection between the development of waqf and the establishment of schools (madrasa) and universities in the African continent and Arab world as civic-initiated-, led, -managed and -funded establishments seeking to achieve “sadaqa jariyah’s” three pillars. According to Saifuddin, education funding through waqf funds has been rated as the second largest recipient of waqf (2014), reflecting the importance of supporting education as a sustainable philanthropic act or sadaqa jariya or waqf. Hundreds of madrasahs (schools) were funded and maintained through waqf in Cairo, Egypt, al Quds in Palestine, Damascus, and Baghdad (Ahmed and Hassan, 2015). According to Gaudiosi (1988) and others, the University of Oxford was influenced by the Waqf system that supported the educational institutions in the Arab World and North Africa.

Examples of university waqf (endowed) institutions include:

- Al Qarawiyyin University in Morocco was established in 850 AD in Fez and is recognized by UNESCO and the Guinness World Record as the world’s oldest existing, continually operating educational institution. It was founded by Fatima Al Fihri through a significant Waqf Fund.

- Al Azhar University in Egypt was established in 970 AD in Cairo and is one of the oldest and most prestigious universities for Islamic studies and most disciplines of science, including medicine.

- Sahnun Madrasa in Tunisia was founded in the 9th century in Kairouan through a considerable waqf fund to support jurisprudence studies.

- Cairo University was established in Egypt in 1908 through a large waqf fund by Princess Fatima and reflected a civic philanthropic movement in the late 19th and early 20th century to build a generation to fight the British Occupation of Egypt.

- Birzeit University in Palestine was initially established by a Palestinian educator, Ms Nabiha Nassir as a school in 1924 (and later as a university) and served as a civic initiative to educate Palestinian youth as a form of civic resistance to the British occupation which began a year earlier. This year, 2024, will mark the 100-year anniversary of Brizeit University,

Concluding Remarks

The philosophy behind waqf portrays the importance of achieving strategic, institutionalized, and perpetual development of communities through one’s philanthropy and generosity. These are the Arab and North African contributions to the world for advancing strategic philanthropy and sustainable community development.

Africa has much to offer to the whole world, above anything, its rich narratives of organized and institutionalized civic-led philanthropy that sustained its generosity and mutual support despite years of brutal occupation and colonialism. It is time for Africa to rise and teach the world how its diverse philanthropic models and acts of kindness can make the world more human, civilized and kind. It is time that the world embraces Africa’s recipe.

Contributor: Marwa El Daly

| Source type | Full citation | Link (DOI or URL) |

|---|---|---|

|

Prof. Dr. Murat Cizakca (2015). The Waqf, its basic Operational Structure, Development, and Contribution. The Global University of Islamic Finance. |

- | |

|

Khalil Ahmed Ibrahim; Dr. Ali, M Yunus; Dr. Shaiban, Mohammed (2019). Waqf Fund Management in Kuwait and Egypt: Can Malaysia Learns from Their Experiences. Monah University Malaysia. |

- | |

|

Marwa EL Daly (2022). Philanthropy, Endowments and Sustainable Social Development in Egypt. Walter de Gruyter |

https://www.degruyter.com/document/doi/10.1515/9783110697032/html?lang=en | |

|

Monica M. Gaudiosi (1988). Influence of the Islamic Law of WAQF on the Development of the Trust in England: The Case of Merton College. |

https://scholarship.law.upenn.edu/penn_law_review/vol136/iss4/6 | |

|

Egypt’s 2014 Constitution (article 90) |

https://www.ohchr.org/sites/default/files/lib-docs/HRBodies/UPR/Documents/Session20/EG/A.HRC.WG.6.20.EGY_1_Egypt_Annex_4_Constitution_E.pdf | |

|

Waqfeyat Misr Foundation |

https://www.facebook.com/waqfeyatmisr/ |