Irish Loan Fund

Credit: http://www.mgrande.com/weblog/index.php/partosdepandora/comments/inconstancia1/

| Giver: | - |

|---|---|

| Receiver: | Individual or unstructured/informal group |

| Gift: | Money |

| Approach: | ROSCA |

| Issues: | 1. No Poverty, 10. Reduced Inequalities, 16. Peace, Justice and Strong Institutions, 8. Decent Work and Economic Growth |

| Included in: | Community Foundations |

The Irish Loan Fund system was a network of privately run community lending organizations that operated in Ireland from the mid-18th to the mid-20th century. In the face of widespread economic insecurity, the funds emerged to provide credit to low-income borrowers who lacked tangible collateral. A critical source of investment capital, these small, low-interest loans were intended to support small enterprise growth, thereby alleviating material poverty and catalyzing long-term social improvement in Ireland’s economically vulnerable communities.

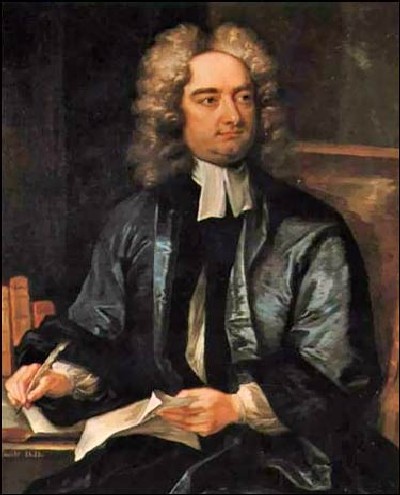

The first loan fund was conceived by the Anglo-Irish author Jonathan Swift (1667–1745). Although he identified as “an Englishman born in Ireland” and a stalwart Protestant, Swift was nonetheless an outspoken critic of British colonial rule. In various pamphlets and treatises, Swift promoted Irish self-sufficiency and political autonomy, while decrying British monetary and land tenure policies that relegated the Catholic majority to severe material poverty.

As Dean of St. Patrick’s Cathedral in Dublin, Swift observed how low-income families without access to capital had little or no means to improve their livelihoods. In 1720, Swift drew from his savings to establish a fund for the purpose of making small (10 pounds or less) interest-free loans to “poor artisans of Dublin.” In lieu of material assets, borrowers could secure their loans through cosigners who assumed joint liability for repayment.

Swift’s lending innovation became increasingly popular over the course of the next century, as charitable organizations, altruistic individuals and other entities established loan funds as a way to transfer much needed investment capital to their communities. Although Swift’s basic principles continued to guide the system, eventually many funds began to charge modest interest rates to sustain themselves.

At their peak in the late 1830s and early 1840s, there were about 300 funds operating across Ireland. Together, they made about 500,000 loans annually to roughly 300,000 borrowers, or 20 percent of all households. Typical borrowers were agricultural laborers, small-scale farmers, craftspeople and tradespeople. About 25 percent of borrowers were women.

Recognizing the social benefits of the loan system – especially by lowering the public cost of caring for those experiencing poverty – the British Parliament encouraged its expansion and introduced regulatory measures to guard against abuses and corruption. In 1836 Parliament established the Loan Fund Board to regulate hundreds of independent loan funds. While individual funds retained their autonomy, they were legally required to follow certain operating standards, including a maximum loan amount of 10 pounds and a maximum term of 20 weeks, with weekly repayments.

From the mid-1840s onwards, the loan fund system experienced a slow but steady decline, due to the prolonged economic shock of the Great Famine, increased competition from commercial banks, and a lack of Parliamentary action to support their continued success. Although a few funds survived into the mid-twentieth century, they had lost their relevance as a financial institution.

Recognized as a pioneering model of microfinancing, the Irish Loan Fund system continues to inform modern-day efforts to provide credit to low-income borrowers who lack access to traditional banking services.

Contributor: Erin Brown

| Source type | Full citation | Link (DOI or URL) |

|---|---|---|

| Book |

Goodspeed, Tyler Beck. Famine and Finance: Credit and the Great Famine of Ireland. Cham, Germany: Palgrave MacMillan, 2017. ISBN: 9783319317656. |

9783319317656 |

| Publication |

Hollis, Aidan, and Arthur Sweetman. “The Life-cycle of a Microfinance Institution: The Irish Loan Funds.” Journal of Economic Behavior & Organization 46, no. 3 (November 2001): 291-311. https://doi.org/10.1016/S0167-2681(01)00179. |

https://doi.org/10.1016/S0167-2681(01)00179 |

| Website |

Mahoney, Robert. “Jonathan Swift as the ‘Patriot Dean/’” History Ireland 3, no. 4 (Winter 1995). https://www.historyireland.com/jonathan-swift-as-the-patriot-dean/. |

https://www.historyireland.com/jonathan-swift-as-the-patriot-dean/ |

|

Piesse, Charles. Sketch of the Loan Fund System in Ireland: and Instructions for the Formation of a New Society: with the Loan Fund Acts, and an Index thereto. Dublin: Alexander Thom, 1841. |

- | |

| Publication |

Hollis, Aidan, and Arthur Sweetman. “Microfinance and Famine: The Irish Loan Funds During the Great Famine.” World Development 32, no. 9 (September 2004): 1509-23. https://doi.org/10.1016/j.worlddev.2004.04.002. |

https://doi.org/10.1016/j.worlddev.2004.04.002 |